Scissor Lift Rental in Tuscaloosa AL: Safe and Reliable Lifting Solutions

Scissor Lift Rental in Tuscaloosa AL: Safe and Reliable Lifting Solutions

Blog Article

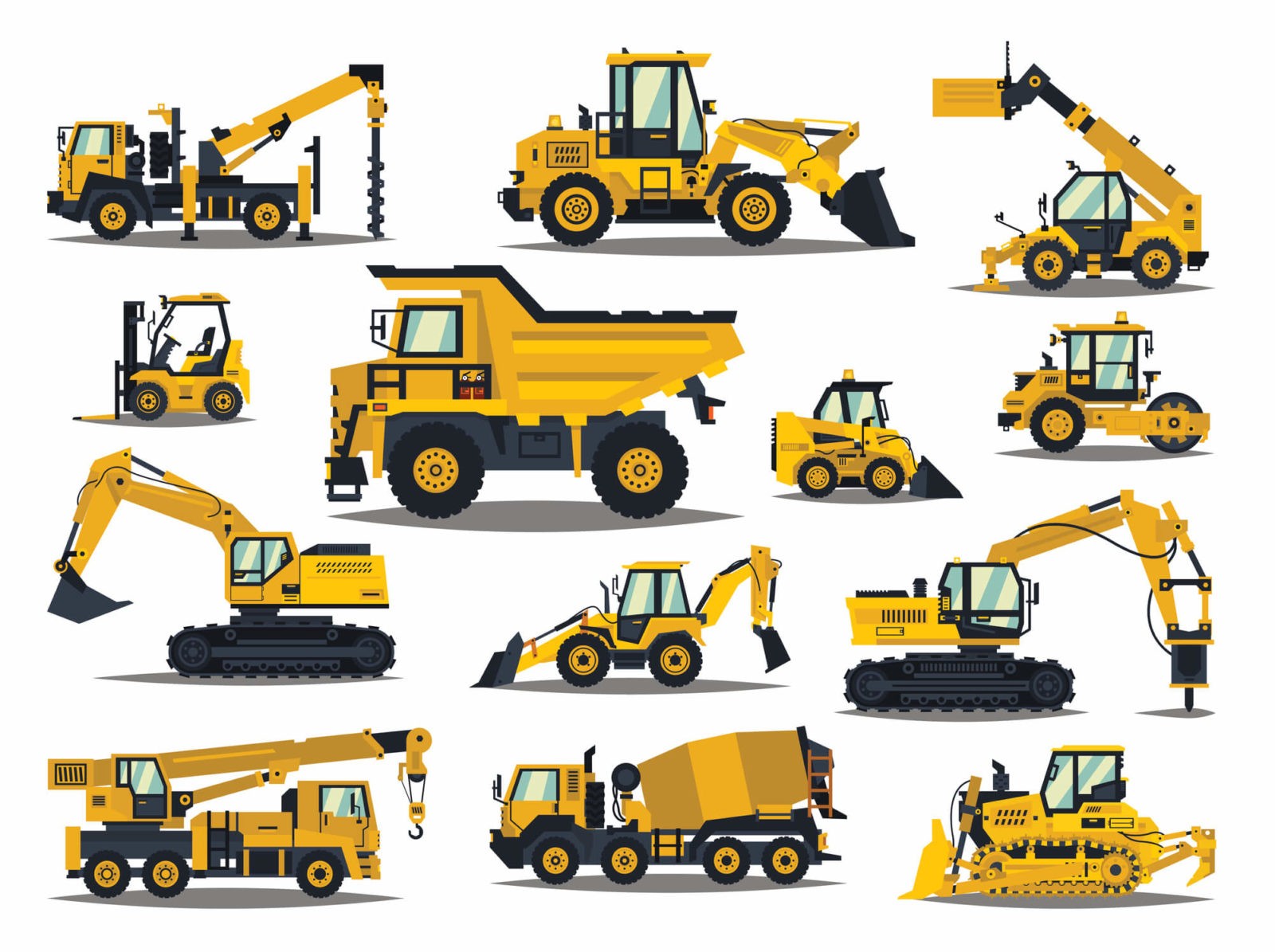

Discovering the Financial Perks of Leasing Building And Construction Devices Compared to Owning It Long-Term

The decision between owning and renting building equipment is pivotal for financial management in the sector. Renting offers instant price savings and operational flexibility, permitting business to designate resources a lot more successfully. In comparison, possession features substantial long-term financial dedications, including upkeep and devaluation. As contractors weigh these alternatives, the influence on capital, project timelines, and modern technology gain access to comes to be increasingly considerable. Recognizing these subtleties is important, specifically when thinking about how they align with particular job demands and economic approaches. What variables should be prioritized to ensure ideal decision-making in this facility landscape?

Price Contrast: Renting Vs. Having

When assessing the monetary ramifications of renting out versus owning building and construction devices, a complete price comparison is necessary for making informed decisions. The selection between having and leasing can considerably influence a firm's bottom line, and recognizing the connected costs is essential.

Renting out construction tools commonly entails reduced ahead of time expenses, allowing companies to allot capital to other operational requirements. Rental expenses can gather over time, possibly exceeding the cost of ownership if equipment is required for a prolonged duration.

On the other hand, owning construction equipment calls for a considerable preliminary financial investment, along with continuous expenses such as financing, devaluation, and insurance coverage. While possession can lead to long-lasting financial savings, it also binds capital and might not supply the exact same level of flexibility as renting. Additionally, having tools necessitates a dedication to its application, which may not always straighten with job demands.

Inevitably, the decision to lease or own ought to be based upon a thorough analysis of certain project requirements, monetary ability, and lasting tactical objectives.

Upkeep Costs and Duties

The option in between leasing and having building devices not just involves financial considerations however also incorporates continuous upkeep expenses and duties. Possessing equipment calls for a substantial commitment to its maintenance, that includes regular assessments, repair work, and prospective upgrades. These obligations can promptly collect, causing unexpected expenses that can stress a budget plan.

On the other hand, when renting tools, upkeep is usually the duty of the rental firm. This arrangement allows specialists to stay clear of the economic problem connected with wear and tear, along with the logistical obstacles of organizing repairs. Rental contracts frequently consist of provisions for upkeep, indicating that professionals can focus on completing jobs as opposed to fretting concerning tools problem.

Additionally, the varied series of tools available for lease enables firms to pick the most up to date designs with innovative technology, which can improve effectiveness and performance - scissor lift rental in Tuscaloosa Al. By selecting leasings, companies can prevent the long-lasting obligation of devices devaluation and the linked upkeep frustrations. Ultimately, evaluating maintenance costs and duties is crucial for making an informed decision about whether to lease or own construction equipment, significantly impacting overall task expenses and functional efficiency

Devaluation Effect On Ownership

A substantial factor to take into consideration in the decision to possess building tools is the effect of depreciation on total possession prices. Depreciation represents the decline in worth of the devices gradually, influenced by aspects such as usage, wear and tear, and innovations in innovation. As equipment ages, its market price lessens, which can substantially affect the owner's monetary setting when it comes time to sell or trade the devices.

For building companies, this depreciation can translate to substantial losses if the equipment is not made use of to its fullest possibility or if it lapses. Proprietors have to make up depreciation in their financial estimates, which can lead to higher overall costs contrasted to leasing. In addition, the tax implications of devaluation can be intricate; while it may give some tax advantages, these are frequently balanced out by the fact of reduced resale worth.

Eventually, the worry of depreciation highlights the importance of comprehending the long-term financial commitment entailed in owning building and construction equipment. Business have to very carefully evaluate exactly how usually they will use the tools and the potential monetary influence of depreciation to make an informed decision concerning possession versus leasing.

Monetary Flexibility of Renting

Renting out building and construction equipment offers considerable economic flexibility, enabling companies to allocate sources extra effectively. This adaptability is specifically essential in an industry identified by rising and fall task demands and varying work. By choosing to rent out, services can avoid the considerable resources expense required for acquiring equipment, preserving cash circulation for other functional needs.

Additionally, renting out devices makes it possible for business to customize their tools selections to specific job requirements without the long-term commitment connected with ownership. This implies that companies can conveniently scale their devices stock up or down based upon expected and current project needs. Subsequently, this versatility decreases the threat of over-investment in equipment that may become underutilized or obsolete with time.

Another monetary advantage of renting out is the possibility for tax obligation advantages. Rental settlements are typically taken into consideration operating costs, enabling immediate tax obligation reductions, unlike depreciation on owned and operated tools, which is spread over several years. scissor lift rental in Tuscaloosa Al. This immediate cost acknowledgment can better enhance a firm's cash position

Long-Term Task Factors To Consider

When evaluating the long-term requirements of a construction company, the decision between renting out and possessing equipment comes to be much more complicated. Key variables to look here think about consist of task duration, regularity of usage, and the nature of upcoming tasks. For tasks with extensive timelines, buying equipment may appear useful as a result of the possibility for reduced general costs. However, if the devices will certainly not be utilized constantly throughout jobs, owning may result in underutilization and unneeded expense on storage, insurance, and maintenance.

The building sector is advancing rapidly, with new equipment offering enhanced heavy lifting equipment performance and security features. This flexibility is especially beneficial for organizations that handle diverse jobs needing different kinds of equipment.

Furthermore, monetary security plays an important role. Possessing equipment commonly entails substantial capital financial investment and devaluation problems, while renting permits even more predictable budgeting and cash money flow. Eventually, the selection between possessing and leasing needs to be lined up with the tactical objectives of the building and construction service, taking into account both anticipated and present project demands.

Conclusion

In final thought, renting construction devices offers significant monetary benefits over lasting possession. Inevitably, the decision to rent rather than own aligns with the vibrant nature of construction jobs, allowing for adaptability and accessibility to the most current equipment without the financial problems linked with possession.

As devices ages, its market worth decreases, which can significantly affect the proprietor's monetary position when it comes time to sell or trade the devices.

Renting out building tools provides significant financial flexibility, permitting firms to allot sources more successfully.Furthermore, renting tools makes it possible for firms to customize their click here now equipment options to particular task demands without the lasting dedication associated with possession.In verdict, renting out building devices uses substantial economic advantages over lasting ownership. Inevitably, the choice to rent out rather than own aligns with the dynamic nature of construction projects, enabling for adaptability and access to the newest tools without the economic burdens linked with ownership.

Report this page